Exactly how to Select the Most Trusted Secured Credit Card Singapore for Your Demands

Exactly how to Select the Most Trusted Secured Credit Card Singapore for Your Demands

Blog Article

Figuring Out the Process: Exactly How Can Discharged Bankrupts Obtain Debt Cards?

Navigating the realm of charge card applications can be a difficult task, particularly for people that have actually been discharged from bankruptcy. The process of rebuilding credit rating post-bankruptcy poses special difficulties, frequently leaving numerous questioning regarding the feasibility of obtaining charge card as soon as again. Nevertheless, with the appropriate techniques and understanding of the qualification requirements, released bankrupts can embark on a trip towards monetary recuperation and access to credit rating. However how precisely can they browse this elaborate procedure and secure credit score cards that can aid in their debt reconstructing trip? Allow's explore the methods available for released bankrupts seeking to restore their creditworthiness via debt card choices.

Understanding Credit Score Card Eligibility Criteria

One key consider charge card qualification post-bankruptcy is the person's credit history. Lenders usually take into consideration credit rating as a measure of a person's creditworthiness. A greater credit rating signals responsible financial actions and might bring about far better credit report card choices. Furthermore, demonstrating a steady earnings and employment background can favorably affect bank card authorization. Lenders seek assurance that the person has the ways to pay back any credit scores reached them.

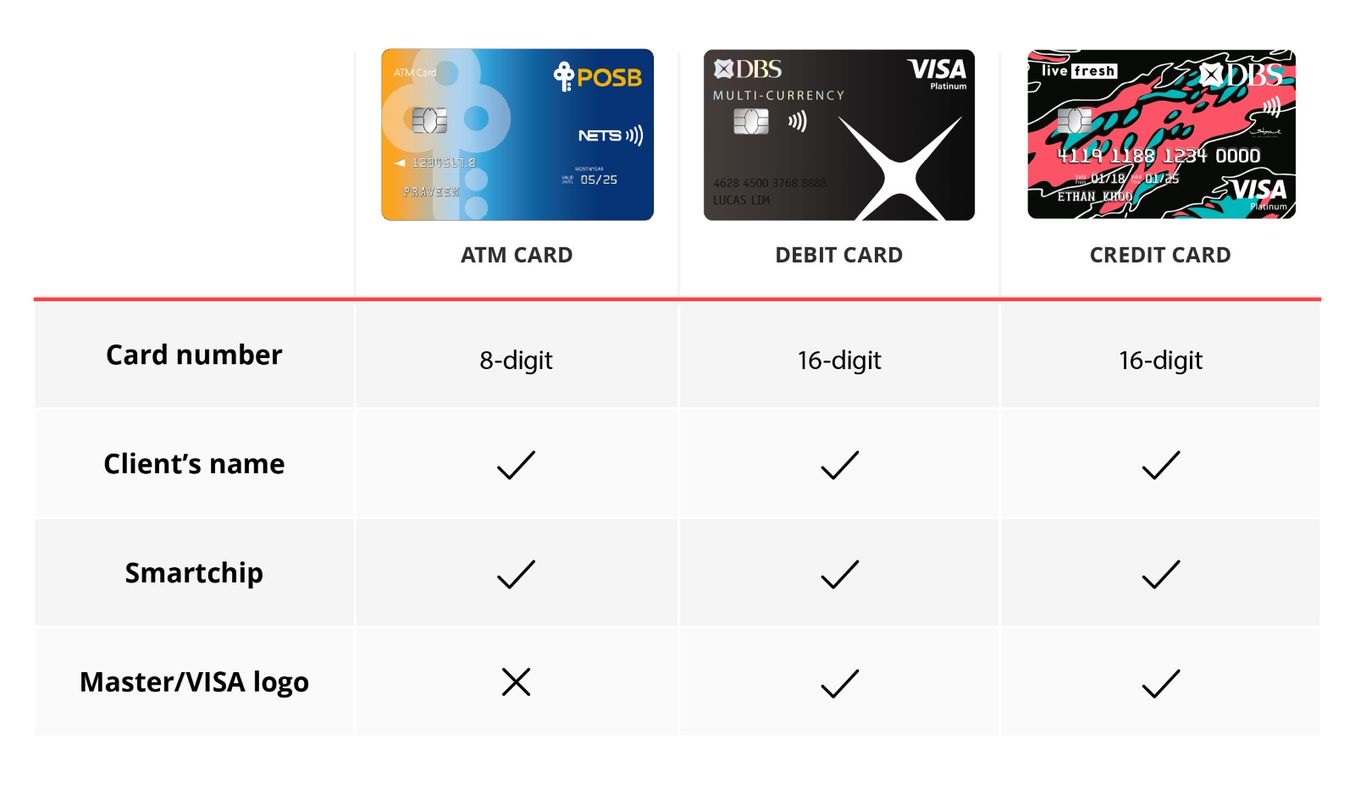

Additionally, individuals should understand the different types of credit cards readily available. Secured bank card, for example, need a money deposit as security, making them much more accessible for people with a history of bankruptcy. By recognizing these eligibility criteria, people can navigate the post-bankruptcy debt landscape extra successfully and work towards reconstructing their economic standing.

Rebuilding Debt After Personal Bankruptcy

One of the first actions in this procedure is to acquire a safe credit rating card. Protected credit cards require a cash deposit as security, making them extra available to people with a personal bankruptcy history.

One more approach to restore credit history after insolvency is to become a certified user on a person else's bank card (secured credit card singapore). This permits people to piggyback off the main cardholder's positive credit rating, possibly improving their own credit rating

Constantly making on-time repayments for expenses and financial obligations is important in rebuilding credit. Settlement history is a substantial consider identifying credit rating, so showing accountable financial behavior is crucial. Additionally, routinely keeping track of credit score reports for errors and errors can help make sure that the details being reported is correct, further helping in the credit score restoring process.

Protected Vs. Unsecured Credit Report Cards

When thinking about credit history card alternatives, individuals may encounter the option in between safeguarded and unsecured credit score cards. Secured credit score cards call for a cash deposit as collateral, commonly equal to the credit history limitation provided. While secured cards provide a path to enhancing credit score, unsafe cards offer more versatility however might be more challenging to get for those with a informative post struggling credit rating history.

Getting Credit Report Cards Post-Bankruptcy

Having actually gone over the distinctions in between guaranteed and unsafe charge card, people who have undergone insolvency may now take into consideration the procedure of making an application for bank card post-bankruptcy. Restoring credit score after personal bankruptcy can be difficult, however obtaining a credit score card is a crucial action in the direction of enhancing one's credit reliability. When obtaining bank card post-bankruptcy, it is vital to be tactical and selective in selecting the ideal choices.

Furthermore, some individuals might get approved for particular unsecured credit history cards particularly created for those with a background of insolvency. These cards might have higher fees or rate of interest, but they can still offer an opportunity to reconstruct credit score when utilized sensibly. Before getting any type of bank card post-bankruptcy, it is recommended to assess the conditions and terms meticulously to comprehend the charges, rates of interest, and credit-building possibility.

Credit-Boosting Methods for Bankrupts

Rebuilding credit reliability post-bankruptcy necessitates applying efficient credit-boosting strategies. For individuals wanting to improve their credit history after personal bankruptcy, one crucial method is to get a protected charge card. Protected cards need a money deposit that functions as security, enabling people to show accountable credit use and settlement actions. By making timely payments and keeping debt use reduced, these people can progressively rebuild their creditworthiness.

One more technique includes becoming an accredited individual on a person else's charge card account. This allows individuals to piggyback off the key account owner's favorable credit rating background, potentially enhancing their very own credit scores score. However, it is vital to guarantee that the main account owner preserves address excellent credit practices to optimize the advantages of this approach.

In addition, constantly checking credit scores records for errors and disputing any type of errors can additionally help in boosting credit rating scores. By remaining aggressive and disciplined in their credit rating monitoring, individuals can gradually boost their credit reliability also after experiencing insolvency.

Verdict

Finally, released bankrupts can get charge card by meeting qualification standards, restoring credit report, comprehending the difference between protected and unsecured cards, and using purposefully. By following credit-boosting methods, such as making timely settlements and keeping credit score application reduced, insolvent individuals can slowly improve their credit reliability and access to credit rating cards. It is necessary for discharged bankrupts to be mindful and diligent in their economic actions to efficiently browse the process of getting credit rating cards after personal bankruptcy.

Comprehending the strict debt card eligibility requirements is crucial for people looking for to get credit cards after personal bankruptcy. While secured cards provide a path to enhancing credit history, unprotected cards supply even more versatility but may be tougher to get for those with a distressed credit scores background.

In verdict, released bankrupts can acquire credit cards by meeting eligibility criteria, rebuilding credit report, recognizing the difference between secured and unprotected cards, and applying strategically.

Report this page